Okay, it’s not exactly that we SHOULDN’T teach our kids to save, or that we don’t actually want them to save. It’s what we’re ACTUALLY teaching them when we are teaching this simple lesson.

Instead of teaching our kids to save, we should be teaching them WHY they should save in the first place. Teaching them WHY is how we begin to change the way they think about money and what it means to live a richer life.

Throughout life, we have all been taught that it’s good to be wealthy, but most of us have had little education about how to get there. We are typically only told to save, but those that advise this are forgetting a major part of wealth accumulation. Saving is absolutely good, and it is okay to teach our children to save. The part that most people forget is the consideration of WHY we should want to save. And the why is what makes the difference between endless consumerism and financial freedom.

By telling youth to save their money no matter what, we are actually teaching them to be spenders rather than savers. This is because they adopt the mindset that they should be saving up their money for something really expensive and are free to spend it all in one place when they can afford it. It’s a save-to-spend cycle & mindset. We are teaching them to put away money and not spend it right away, until they can afford that item down the line. This tells them that it’s okay to want something they can’t have and to buy it later when they’ve saved up enough, and instills the idea that expensive things are more valuable and to endlessly seek that next big ticket item.

However, value does not come from the cost of an item, but rather its meaning to you. We can all agree that saving is not bad (in fact, I do encourage saving a percentage of all money that comes in), but it’s only half the lesson.

We should be teaching our children the most important step in financial freedom:

Step 1: What is your WHY?

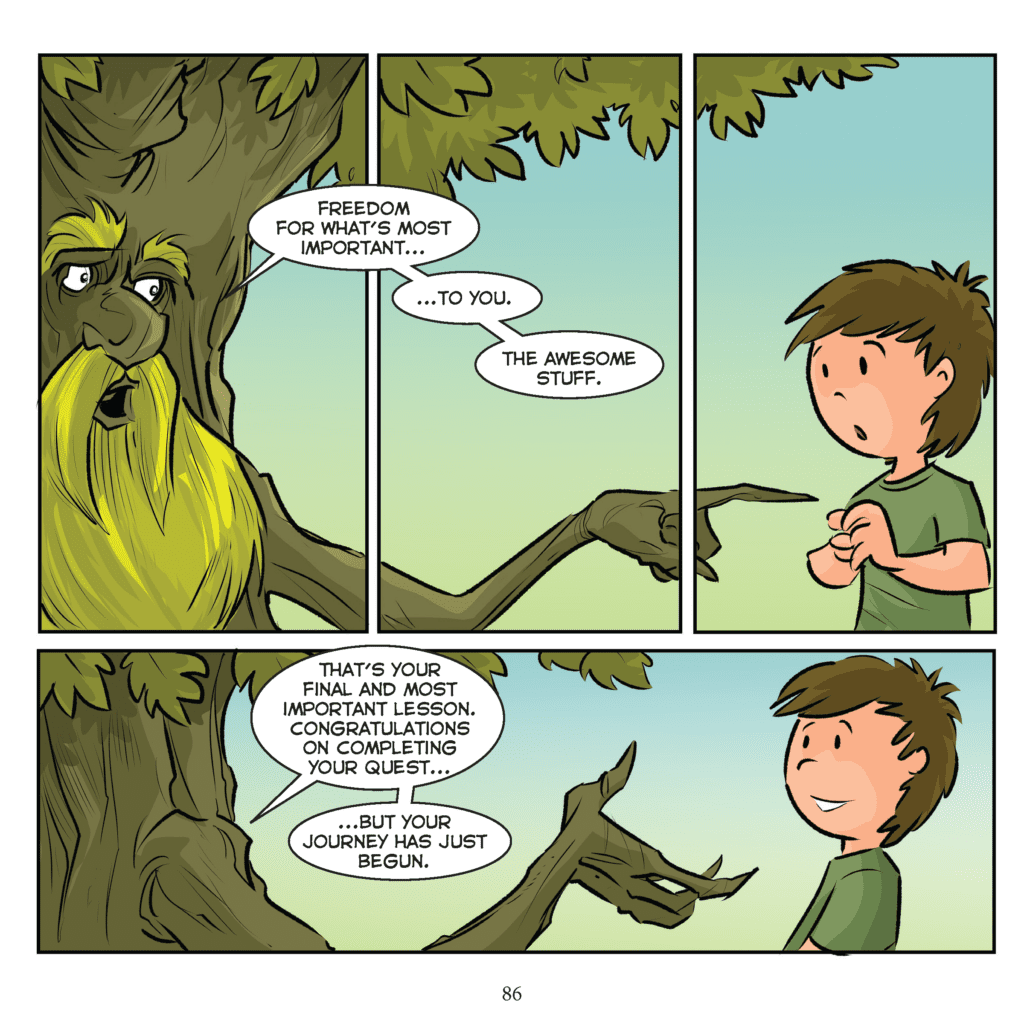

We can teach our kids to save, but we cannot forget to teach them about the pause and reflection that should come with wanting to purchase something. We need to help them figure out what is most important to them. Ask them: WHAT items do you want the most? WHY do you want these items? We need to teach them to buy only these things, their Awesome Stuff, and not waste their time and money saving up for things that eventually won’t matter to them.

Teaching our kids to save isn’t bad, but forgetting to teach them why they should save is. It’s a lot easier to save when you understand why you’re doing it. Teach your kids about the power of compound interest and how every dollar they save is actually earning more money for them so that they’ll have more later on. Kids understand this concept and can be encouraged to save in order to see it happen and to have more money in the future.

Instead of teaching our kids that money is meant to be spent once you have enough of it, let’s teach them to think about why they might want to spend it and what purchases will be worth spending it on, whether they’re expensive or not.

The reason we save is to ensure personal financial freedom. We want to be able to make decisions to spend money on what’s important to us. This is how we build wealth: not by buying more stuff, but by putting our money away to grow and creating financial freedom by creating an income stream that will last forever.

Rather than only teaching kids to save (and ensuring that they will spend their whole lives wanting more and saving up for the next big thing), we need to teach them to have a healthy mindset around money. By urging them to consider what their Awesome Stuff is and why they want it they will grow to have a much healthier mindset around money.